Tuesday 28 December 2010

Tuesday 21 December 2010

live trade call cable short

short cable at 5492, stop at 5520, target 5455

Monday 20 December 2010

short euro at 3149, with 20 pip stop

short euro at 3149, with 20 pip stop

my trades for this evening

I have gone short on the euro at 3155, with a stop at 3194 first bear flag. I have a 2:1 profit target at 3083.

I have an order to go short cable at break of 5495, stop at 5527, profit target at 5328 and another order to go long on

USDJPY at 84.14, stop at 84.06, with a profit target at 84.36.

Sunday 19 December 2010

Bullish Hammer Candlestick Pattern

Bullish Hammer Candle Pattern

So last time we looked at candlesticks and what they mean to us, now we can look at some of the various candlestick patterns and what they mean to our trading when we see them.

So, without further a due, let me introduce to you the hammer pattern.

The hammer has a small upper body with the open and closing price being in the upper third of the entire wick of the candle as shown above with a long tail which is preferably a minimum of 3 times the length of the real body. It may or may not have an upper shadow but if it does it will be small. The colour of the real body does not matter.

Now we know how to identify, what do they mean to us? Well first off the tail indicates that there was selling pressure but the sellers were unable keep the price lower and buyers step ion to close the candle at it high and near its open indicating that buyers have won this session and the next move is likely to be a move higher. So do we care where on our chart we see it? Yes, we do. The hammer needs to follow a downtrend as it is a reversal candle and it indicates that buyers are now ready to take control and push the price higher.

Points to remember.

- The lower shadow should be at least twice the length of the body.

- The upper shadow is very small or non existent

- It is followed by a downtrend

- The colour of the body does not matter

Hope you enjoy.

The PipMeister.

Japanese Candle Stick Patterns

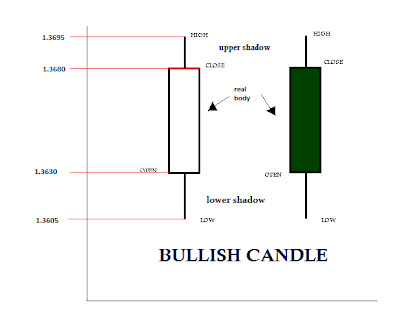

So if your going to trade the forex markets then in my opinion your going to need to look at Japanese Candle Stick Patterns; so what is a candle stick, first off, it's the thing that will tell you the price the market has and is trading at, so lets look at a candle and see what we can learn.

OK, so first of both candles are showing the exact same information so we can use either; I will go with the one on the left, and what we see is that the market opened at 1.3630 and traded as high as 1.3695 and as low as 1.3605 before finally closing at 1.3680. So the price of the candle is moved by the buyers and sellers in the market place so when we see that we have a candle opening at 3630 and then closing at 1.3680 then we know that buyers have won the day as they closed the market at the higher price. We also know this visually as the white or green body is the default setting for a buyer's candle on most charting software. The upper shadow shows how high above the closing price the market traded and the lower shadows represent how much lower than the opening price the market traded for that period, this is important to know (which we can discuss further with I get enough requests to), and is why I give priority to candles over OHLC bars and so forth.

This is known as a bullish candle indicating that the market was rising for that period. The period in question would also depend on the timeframe for that chart, so if we look at a daily chart then each candle would represent one 24hr period of trading, where as on a 60 min chart, 1 candle would represent 1hr's worth of trading.

That was a bullish candle and now we look at a bearish candle.

OK, so using the first candle on the left, we have a market that has opened at 1.3680 and traded as high as 1.3695 and as low as 1.3605 before finally closing at 1.3630. So using the same logic as the last candle this time we can see the sellers have closed the market down from its open 3680 to close at 3630 so this time we know that the sellers have won the day as they closed the market at the lower price. We also know this visually as the black or red body is the default setting for a buyer's candle on most charting software. The upper shadow shows how high above the opening price the market traded and the lower shadows represent how much lower than the closing price the market traded for that period, again this is important to know (which we can discuss further with I get enough requests to).

This is known as a bearish candle indicating that the market has fallen for that day if we were looking at a daily chart and so forth.

So I hope this helps, it is only the start I will cover more as we go on, till then feel free to drop a comment or ask a question and happy pip collecting.

The PipMeister

Friday 17 December 2010

So hear is my first trade call for this post

I am long EURUSD at 1.3264 with a stop loss at 1.3235 17th Dec 2010.

so I have a limit order at 1.3333 and I'll call in on it later.

Stopped out, such is the game of trading. At 1% risk per deal we lose 1% but I did gain 7% on the eurusd with a trade placed at 3am and closed out this morning, so 6% up for the day.

so I have a limit order at 1.3333 and I'll call in on it later.

Stopped out, such is the game of trading. At 1% risk per deal we lose 1% but I did gain 7% on the eurusd with a trade placed at 3am and closed out this morning, so 6% up for the day.

live trade calls

I will posting my live trade c alls and also market orders, so be sure to follow me on my blog.

friday 17 dec 2010

go to see my news outlook for friday 17 dec 2010

http://www.youtube.com/watch?v=ivmAUUUj3ns

The PipMeister

http://www.youtube.com/watch?v=ivmAUUUj3ns

The PipMeister

Wednesday 15 December 2010

what would you want from a currency(forex) trading course?

What would you want from a course teaching you how to trade? would it be strategies, basics, live chart analysis and trading, risk management, a bit of every thing maybe? how long should it last and what would that be worth to you in monetary terms?

post back and let me know so we can let those providing courses know what you want from such a course.

The Pip Meister.

post back and let me know so we can let those providing courses know what you want from such a course.

The Pip Meister.

Tuesday 14 December 2010

Are you a retracement or a contrarian trader? who wins?

so what is your style of trading? do you look for pullbacks with the main trend behind you? or do you trade against all the rules? i guess this comes down to the individual but what is the best option? So I will give my you my opinion.. Ready? in my opinion you are always best to stay safe so I always say trade with the ongoing traffic, with the main trend and look for a pullback to a level where you buy or sell off with a tight stop behind your level; obviously this easier said than done and some would say that if you trade as every one does then you are simply cauhht up in the heard psychology thing and we all know that 85% of all retail traders wipe their accounts and many never ever trade again.

But, with that said if you trade against the main trend as a position trader then you are onto a loser before you've even begun, but as a scalper or a day trader looking for quick profits for 30 pips or so then this approach will work for you, for myself however I prefer to position trade and automate most of the process if not the whole process itself and this I have found I can only do consistently if i trade retracements with the main trend so the conclusion is it depends on your style of trading and the one that works for you will work for you.

please send any comments..

The pip Meister.

But, with that said if you trade against the main trend as a position trader then you are onto a loser before you've even begun, but as a scalper or a day trader looking for quick profits for 30 pips or so then this approach will work for you, for myself however I prefer to position trade and automate most of the process if not the whole process itself and this I have found I can only do consistently if i trade retracements with the main trend so the conclusion is it depends on your style of trading and the one that works for you will work for you.

please send any comments..

The pip Meister.

Subscribe to:

Posts (Atom)